Accounting is inseparable from the activities of a commercial enterprise. Whatever the company’s structure, it is required to manage invoices, make tax returns, etc. See in this article how to successfully manage your company’s finances.

The Importance of Accounting for a Company

Accounting is the area that deals with cash flow within a company. It allows the collection of information on the inputs and outputs. In general, the accounting operations include daily activities.

As a result of all the calculations, the company must know the state of its finances, the profitability of a given market, the amount that remains to be paid to suppliers, etc. Moreover, all companies must make an annual balance sheet because it is the basis for their tax return.

To have an objective overview of the company’s financial situation, the company should have a separate bank account. The purpose of opening a business account is to separate the company’s assets from those of the manager.

Transcription of Accounting Operations

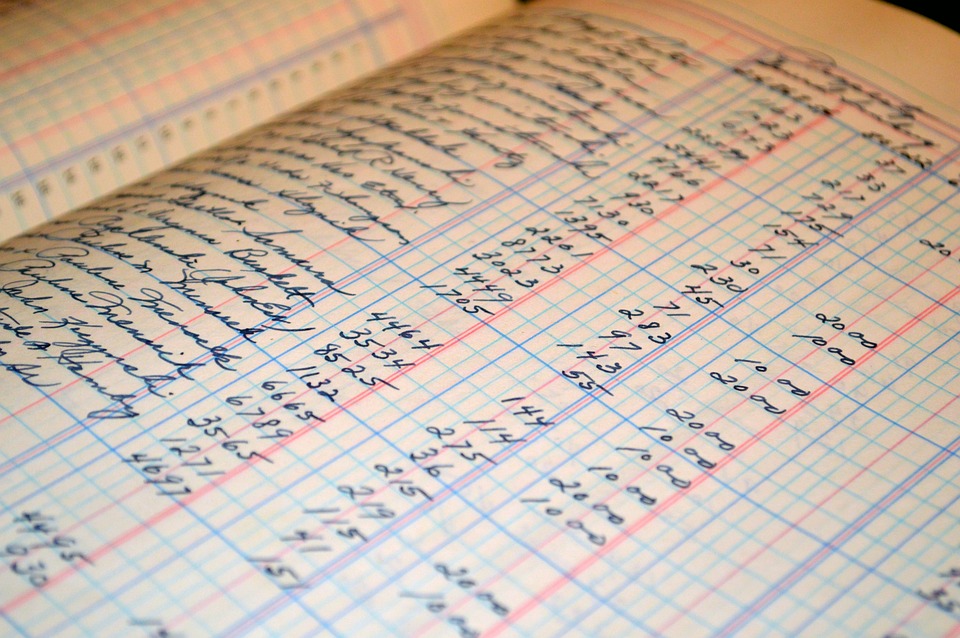

The management of a company’s accounting is based on the elaboration of an accounting book (or ledger). This instrument’s objective is to transcribe all the operations carried out by the company (purchase or sale). To do so, it will be necessary to use the 8 classes of the general chart of accounts, i.e., the capital accounts, the expense accounts, the income accounts, etc. To transcribe all the operations in your accounting book, you must keep the invoices of all the processes.

The Use of Efficient Tools for Accounting Management

To facilitate the management of your business, you can use different processing software.

– The invoicing software

The invoicing software allows you to generate invoices from a predetermined model. To use it, integrate the list of customers and the list of goods in a database. When writing the invoice, you will only have to use the codes corresponding to each.

– The accounting software

To manage all your accounting operations, link the invoicing software to your accounting software. This will allow you to record all the invoices automatically. You should know that different software packages are adapted to each company structure. Some sectors of activity and some large companies can order custom-made software. The objective is to provide software that meets the company’s real needs.

Note that the acquisition of this software is not free. Generally, 2 cases can occur: either you buy a license from a supplier or sign a collaboration contract. This second option gives you access to maintenance and update services.

Outsourcing accounting

Outsourcing consists of entrusting the management of your accounting to an external company or service provider. This collaboration allows you to benefit from the help of a chartered accountant. The outsourcing of accounting has many advantages for the company. Indeed, it is always interesting for a company to collaborate with an experienced professional in the launching phase. It also allows the company to focus on the development of its activities. In terms of cost, outsourcing will enable you to dispense with an in-house position.

The role of an external accountant is to:

– record all accounting operations

– establish an annual balance sheet

– manage employee payroll and all other social charges

– take care of tax returns

– provide legal assistance

When choosing an accounting firm to work with, consider the service’s price and the agency’s proximity. You should also be aware that a public accountant must belong to an order.